spread forex meaning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. We work to keep our spreads among the lowest in the business.

Spread Definition Forexpedia By Babypips Com

This marked a 16 increase on the 258bn from October 2020 and a 20 increase on April 2020.

. Trading is facilitated through the interbank market. The minimum spread is 04 pips and the average spread is 12 pips for commonly traded major forex pairs. For our minimum spreads please see our forex spread bet and CFD details.

According to the Bank of Englands semi-annual FX turnover survey published on 2 July average daily reported foreign exchange turnover reached 298bn in April 2021. A commission-based fee structure usually suits other tradable assets such as stocks and shares. The Forex Reversal is an indicator for the MT4 platform.

Spot Gold and Silver contracts are not subject to regulation under the US. The difference in yields between two fixed-income securities with the same maturity but originating from different investment sectors. A forex spread bet enables you to speculate on the future price direction of a currency pair.

The foreign exchange market is at best a zero-sum game. These products are appropriate for the following individuals. The best forex broker offering MT4 is Pepperstone which has some of the lowest spreads in 2022 fastest execution speeds combined with good trading customer service.

Users can also sign up to test free forex simulator software. Forex is the most traded market in the worldIt continues to grow. The best forex platform is MetaTrader 4 based on the popularity of the trading software reliability and automated trader facilities.

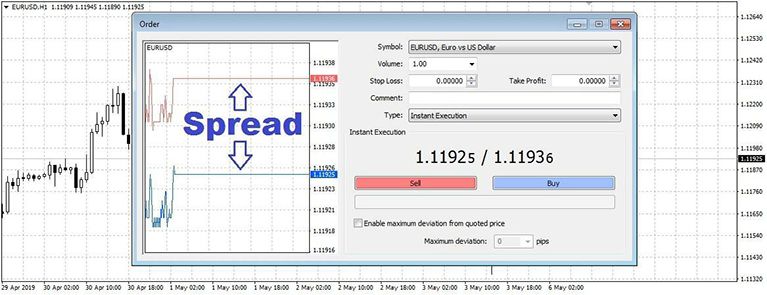

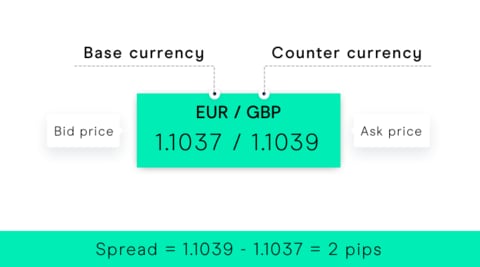

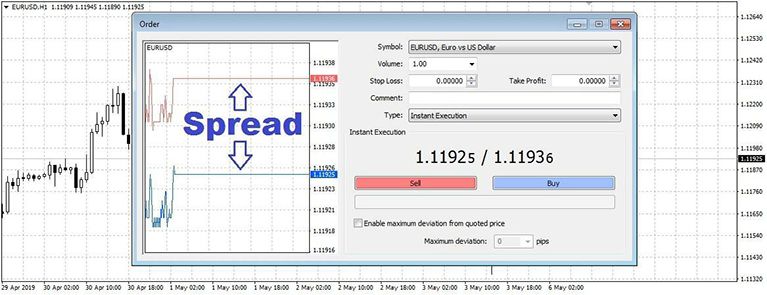

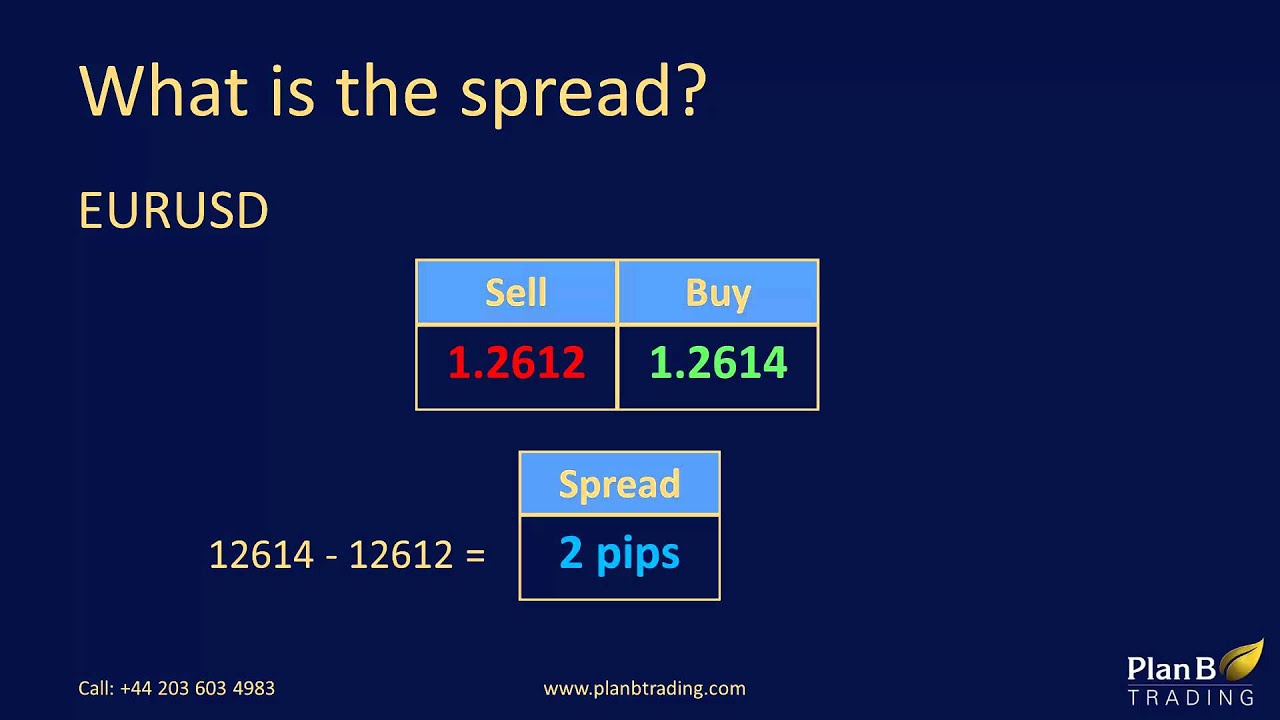

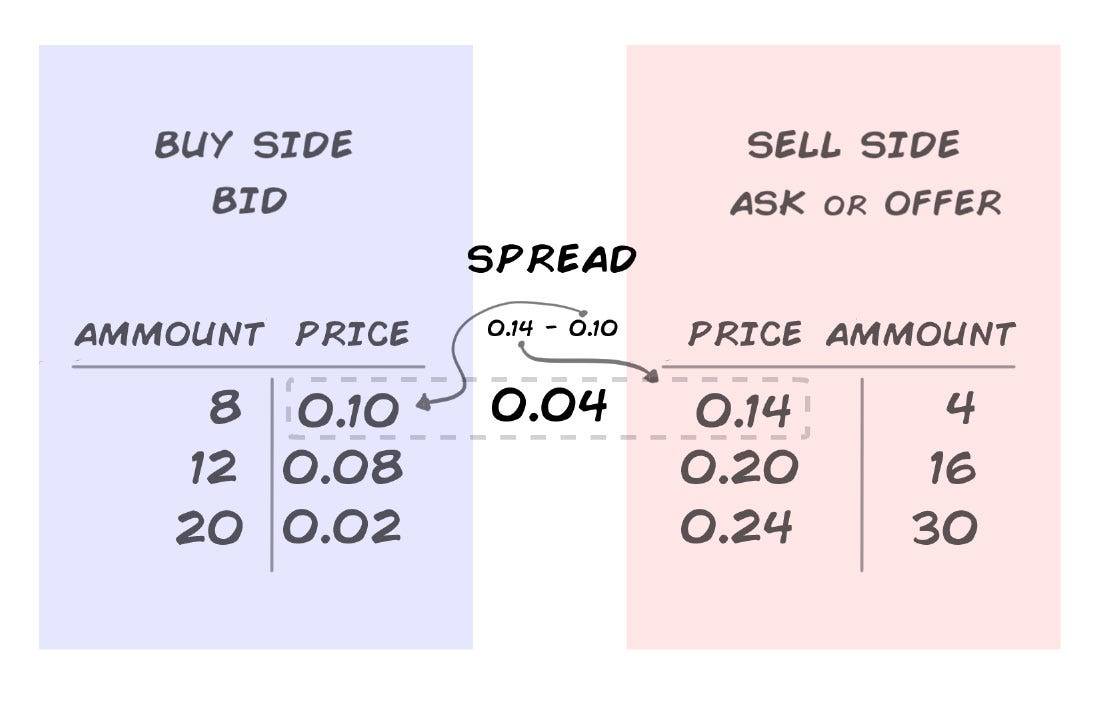

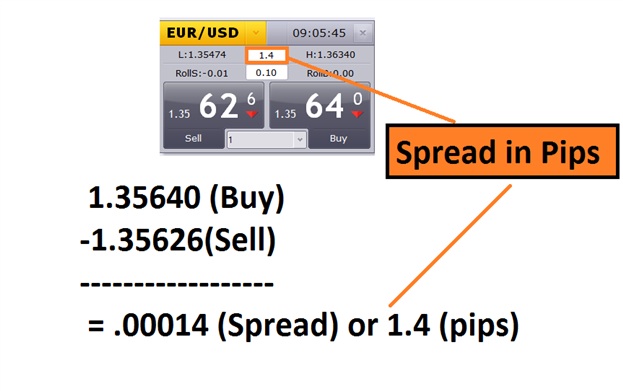

8 Average spread Monday 0000 - Friday 2200 GMT for the 12 weeks ending 19th March 2019. The spread is the difference between the buy and sell price of a Forex pair and is measured in pips the smaller or tighter the spread the less money you spend when you make a trade. This means that the forex broker makes their money primarily from the difference between the ask and sell price of any forex pair.

If this is a bit overwhelming check out. Becoming a well-seasoned forex trader can take years so its no wonder more newbies are turning to forex EAs for easy access to the market. The spread can be used to calculate the.

The spread is the difference between the buy and sell price of a Forex pair and is measured in pips the smaller or tighter the spread the less money you spend when you make a trade. Forex trading involves significant risk of loss and is not suitable for all investors. Intermarket Sector Spread.

Forex is an over the counter market meaning that it is not transacted over a traditional exchange. We hand pick every system and provide you with a. Though not actually a cost to you the margin you pay makes a big difference to the affordability of your forex trade.

The bottom line is that forex EAs are a superb way to trade without lifting a finger meaning that you can avoid the need to understand charts and research for months on-end. If two currency pairs go up at the same time this represents a positive correlation while if one appreciates and the other depreciates this is a negative correlation. For example divergences harmonics pattern recognitions volume spread analysis the good old moving average MACD etc.

Intermarket sector spreads in the. 7381 of retail investor accounts lose money when trading CFDs with this provider. Your key payment for forex is the the spread - the difference between the buy and the sell price - our charge for executing your trade.

Build an automated portfolio of forex trading systems. With forex trading you can speculate when forex prices are rising as well as falling as compared to other currencies. Meaning that once an arrow appears then that arrow.

Lets say that the bid price is 10115 and the asking price is 10120 the spread is 5. There is also a commission charge for Forex Direct. With some brokers it is completely free while with others there is a small markup spread this is due.

Forex Diamond EA is the next step in our journey to continue raising the bar for the Forex trading community. Regulated vs Unregulated Forex Brokers. Currency correlations or forex correlations are a statistical measure of the extent that currency pairs are related in value and will move together.

The truth is many of these have time tested concepts hence it would be a folly to totally ignore them. Sadly but none of the Unregulated Brokers are in our comparison list or marked as recommended onesThe biggest lack of Unregulated or Offshore Broker is regulation meaning gap of safety itself. Our team knew that we had superior strategies for dominant market trend trading highly volatile small spread trading and countertrend trading.

A spread is measured in pips so the above would be called a 5 pip spread. Free Forex Simulator Software Download. The top forex markets right now.

Just choose the right simulator application learn how and when to use the trading application assess your forex plan and enjoy trading. A forex exchange or equity markets simulation is the perfect way to begin practice trading financial markets. In Forex the spread is basically the difference between the bid and ask price of a currency pair.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Commission is charged by some brokers every time a trade is opened or closed. 1 pip fixed spread forex brokers are out there and ECN brokers may even deliver zero spreads.

Traders should always be looking for forex brokers with the lowest spread. It will be automatically synced with your connected trading account meaning every order will be replicated in your trading account. Commission is charged by some brokers every time a trade is opened or closed.

Foreign exchange fraud is any trading scheme used to defraud traders by convincing them that they can expect to gain a high profit by trading in the foreign exchange marketCurrency trading became a common form of fraud in early 2008 according to Michael Dunn of the US. Forex is traded on margin meaning you can gain a potentially higher market exposure by putting down just a small percentage of the full value of your trade. Besides most of world regulators forbid and restrict offshore or unregulated brokers from accepting the residents alike none of offshore.

Spread betting is a derivative product which means you dont take ownership of the underlying asset but speculate on whichever direction you think its price will move up or down. FX CFDs and Spread Bets are offered for trading at OANDA on an execution only basis meaning no advice or recommendation is given nor monitoring or risk management assistance provided. Forex Spread.

Lets look at an example. Commodity Futures Trading Commission. 7 Average spread between 0000-2100 GMT Monday to Friday for the 12 weeks ending 8th January 2021.

What Is Spread In Forex Learn Forex Cmc Markets

Forex Trading Academy Best Educational Provider Axiory Global

What Is A Spread The Definition And Its Role In Forex Trading

Forex Spread What Is The Spread In Forex And How Do You Calculate It Ig Ae

Forex Spread What Is The Spread In Forex And How Do You Calculate It Ig Ae

What Is Spread Profitf Website For Forex Binary Options Traders Helpful Reviews

What Does A Forex Spread Tell Traders

What Does A Forex Spread Tell Traders

04 What Is Spread Fxtm Learn Forex In 60 Seconds Youtube

How To Trade Forex News An Introduction

What Is Spread In Trading And How To Beat It Etx Capital

Forex Spread What Is The Spread In Forex And How Do You Calculate It Ig Ae

Understanding Spreads In Trading With Cryptocurrencies By Keno Leon Medium

What Is A Spread The Definition And Its Role In Forex Trading

Spread Definition Forexpedia By Babypips Com

What Are Fixed And Variable Spreads Andyw

Bid Ask Spread Definition Forexpedia By Babypips Com

What Is Spread In Forex Currency Pairs General Mql5 Programming Forum